The Simple, Secure, and Easiest Way to File Your Taxes

Get your income tax return filed quickly and accurately with our professional service. Our team ensures your return is error-free and maximizes your tax savings, all while providing expert assistance from certified CA’s.

Ready to File Your Income Tax Return?

Legalsuvidha is here to make the process seamless and efficient. Whether you choose to file yourself or want expert assistance from a Chartered Accountant (CA), we have the right solution for you.

- Easy Online Filing

- Expert CA Assistance

- Secure and Reliable

- Affordable

- Timely and Accurate

Get Started

How it Works?

Know how our CA assisted Online ITR filing Works.

Access online CA consultations and securely upload your documents.

Experience comprehensive CA services all in one place. Just provide your name, email, and phone number, make the payment for our professional services, and receive your dedicated eCA.

Your CA consultant reviews your documents and schedules a call.

Your documents are meticulously reviewed for accuracy and completeness. Your eCA will then reach out to discuss your income, investments, and deductions to maximize your refund.

Sit back and let us handle Everything.

We take care of maximizing deductions and saving you money on taxes. Our team is well-versed in the tax laws that apply to you. Additionally, we verify Form 26AS with the department to ensure you receive the maximum benefit from your TDS.

Review and Finalize Your ITR Filing

Receive a thorough summary of your Income Tax Return for your review and approval. Once you've signed off, your return can be submitted directly through your dashboard. Let us guide you through a seamless and efficient tax filing experience.

Are you a Individual?

Trust us to handle your taxes with precision and speed, so you can enjoy peace of mind and get back to what matters most. Let us take care of your tax filing needs in no time!

Error Free Filing.

We ensure your tax return is accurate and free of mistakes.

Maximum Tax Savings.

Our experts find every deduction & maximize savings.

CA-Assisted Filing.

Certified accountants guide you through the process for peace of mind.

Avoid Penalties.

Filing your ITR late can result in a fee of up to INR 10,000.

Unsure Which Tax Return to File?

Choose the appropriate form based on your income sources.

- ITR 1

- ITR 2

- ITR 3

- ITR 4

- ITR 5

- ITR 6

- ITR 7

ITR-1 is for resident individuals with a total income of up to INR 50 lakhs. It applies to:

- Income from salary or pension.

- Income from a single house property (not including cases where losses need to be carried forward).

- Income from agriculture up to INR 5,000.

- Income from other sources (excluding winnings from lotteries and race horses).

- Income from salary or pension.

- Income from house property.

- Income from capital gains.

- Income from other sources, including lottery winnings and income from racehorses.

- Income from agriculture exceeding Rs. 5,000.

- Holding foreign assets or earning foreign income.

- Additionally, if you are a company director or have investments in unlisted equity shares at any time during the financial year, you must file ITR-2. This form is not for individuals with income from business or profession.

- Income from salary or pension.

- Income from house property.

- Income from capital gains.

- Income from other sources, such as winnings from lottery and income from racehorses.

ITR-7 is available for individuals, including companies, who are required to file returns under the following sections:

- Section 139(4A): Trusts with income.

- Section 139(4B): Political parties.

- Section 139(4C): Entities engaged in scientific research.

- Section 139(4D): Universities and colleges.

Necessary Documents for Filing Income Taxes.

Pan Card

AADHAR Card

Bank Statement

Form 26AS

Form 16

Form 16A/16B

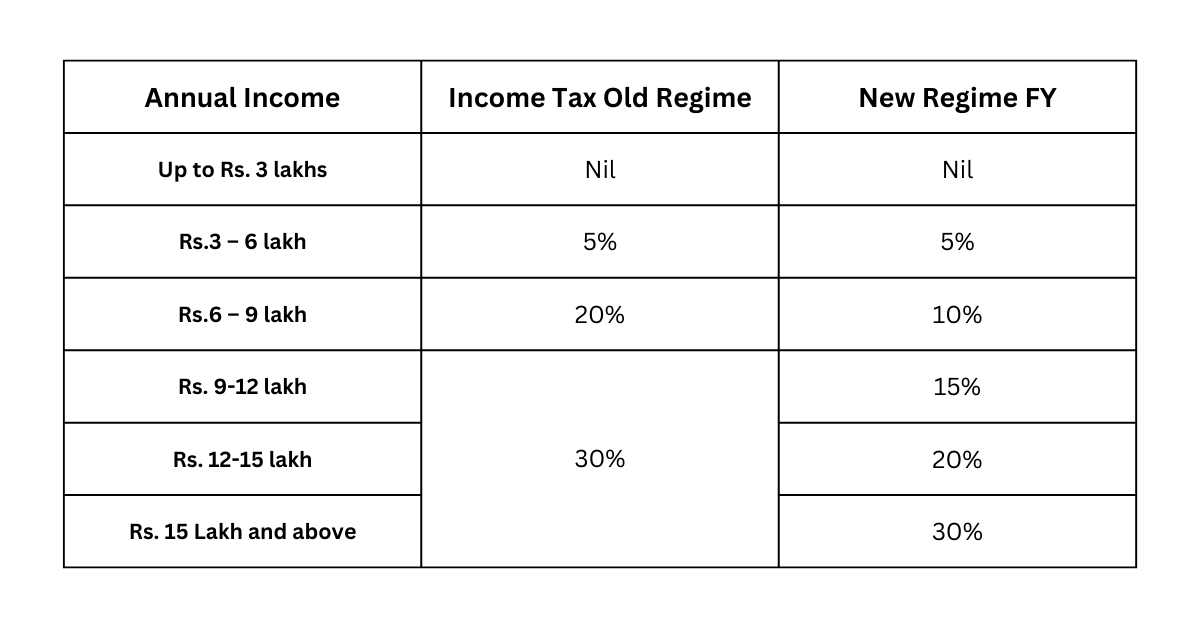

Old vs New Tax Regime

Know difference between the old and new tax regimes can significantly impact your tax savings and deductions.

This Service is For

Our personalized tax services cater to salaried employees, individuals with rental income, and senior citizens with interest income. We aim to minimize your tax burden while maximizing your savings.

- Salaried Employees.

- Rental Income Earners.

- Senior Citizens.

- Self-Employed Professionals.

- Investors.

- Income from Agriculture.

Get Your ITR Filed by Certified CA's

Need help with your taxes and filings? Get in touch with our certified accountants for precise and efficient ITR filing. Let our experts handle your tax needs with accuracy.

Get Started

Find Answers to Common Questions Online!

If your financial situation involves complex income sources, investments, or deductions, consulting with a CA can help ensure accurate filing and maximize potential refunds. Legalsuvidha's experts can assist you with seamless and precise ITR filing.

Expert CA assistance ensures accurate and reliable tax filings, compliance with tax laws, error minimization, tax optimization, audit support, and peace of mind. Their guidance saves you time and offers tailored solutions.

Yes, Legalsuvidha offers eCA-assisted services for various types of income, including capital gains, foreign income, NRI income, multiple Form 16s, business income, and more.

Yes, your information's security and confidentiality are a top priority when using the eCA-assisted option on Legalsuvidha.

Legalsuvidha provides easy and accessible online tax filing, professional CA expertise, precision and error-free filing, deadline adherence, secure document handling, updated tax information, and ongoing support.

Legalsuvidha's tax experts identify the reasons for the Defective Return Notice and help revise your ITR accordingly.

Legalsuvidha offers CA assistance at a competitive and affordable price, making it accessible for all.

When filing an Income Tax Return, a tax expert may need the following documents:

Personal Details:

PAN (Permanent Account Number)

Aadhaar Card

Contact details (address, phone number)

Bank account information.

Income Documents:

Form 16 for salaried individuals

Bank account statements

Interest certificates from banks or post offices

Details of rental income

Information on income from investments, freelancing, or other sources

Investment Records:

Investment documents like receipts, certificates, or statements (e.g., ELSS, PPF, NSC, etc.)

Proof of insurance premium payments

Home loan certificates, if applicable

Deductions and Exemptions:

Receipts and proofs for deductions under

Sections 80C to 80U (e.g., LIC premiums, tuition fees, etc.)

Medical bills and health insurance premium receipts

Donation receipts for deductions under Section 80G

Property Information:

Property ownership records for calculating income from house property (e.g., rental income, home loan interest)

Capital Gains:

Details of capital gains from the sale of property, stocks, mutual funds, and other investments

Business/Professional Information (if applicable):

Profit and loss statements

Balance sheets

Proof of business expenses

Other Relevant Documents:

Any other receipts or documents related to income or deductions that apply to your specific situation

Our Testimonials

People Who loved our services!

EXCELLENTBased on 414 reviews

Gaurav Saraswat2024-04-03Prompt service, courteous and knowledgeable staff makes the whole transition smooth and Hassel free. Also very competitive pricing . Regards Gaurav Saraswat CFO- SCFPL

Gaurav Saraswat2024-04-03Prompt service, courteous and knowledgeable staff makes the whole transition smooth and Hassel free. Also very competitive pricing . Regards Gaurav Saraswat CFO- SCFPL Vaibhav Patel2024-03-18Good job done by legal suvidha for startup recognition certificate. They guide us so well at every steps. Recommending them for their services.

Vaibhav Patel2024-03-18Good job done by legal suvidha for startup recognition certificate. They guide us so well at every steps. Recommending them for their services. Account Department2024-03-18I recently applied for a Startup India certificate through Legal Suvidha, and I was thoroughly impressed by their professionalism. From the moment we initiated the process, we received proper guidance in every step. Saloni, one of the team member helped us very patiently and ensured a seamless procedure . Thanks to their team, that I obtained my certificate within few working days.

Account Department2024-03-18I recently applied for a Startup India certificate through Legal Suvidha, and I was thoroughly impressed by their professionalism. From the moment we initiated the process, we received proper guidance in every step. Saloni, one of the team member helped us very patiently and ensured a seamless procedure . Thanks to their team, that I obtained my certificate within few working days. Shaks SHAKS Shaks2024-03-18Very sharp and accurate and professional Meter & Cents

Shaks SHAKS Shaks2024-03-18Very sharp and accurate and professional Meter & Cents Harry's s2024-03-12Great service, Their Team is really hard working and amazing experience with legal suvidha now i am going to continue for all the work regarding my private limited company.

Harry's s2024-03-12Great service, Their Team is really hard working and amazing experience with legal suvidha now i am going to continue for all the work regarding my private limited company. Raghu G2024-03-06Good communication and got things quickly

Raghu G2024-03-06Good communication and got things quickly

Our Testimonials

People Who loved our services!

EXCELLENTBased on 414 reviews

Gaurav Saraswat2024-04-03Prompt service, courteous and knowledgeable staff makes the whole transition smooth and Hassel free. Also very competitive pricing . Regards Gaurav Saraswat CFO- SCFPL

Gaurav Saraswat2024-04-03Prompt service, courteous and knowledgeable staff makes the whole transition smooth and Hassel free. Also very competitive pricing . Regards Gaurav Saraswat CFO- SCFPL Vaibhav Patel2024-03-18Good job done by legal suvidha for startup recognition certificate. They guide us so well at every steps. Recommending them for their services.

Vaibhav Patel2024-03-18Good job done by legal suvidha for startup recognition certificate. They guide us so well at every steps. Recommending them for their services. Account Department2024-03-18I recently applied for a Startup India certificate through Legal Suvidha, and I was thoroughly impressed by their professionalism. From the moment we initiated the process, we received proper guidance in every step. Saloni, one of the team member helped us very patiently and ensured a seamless procedure . Thanks to their team, that I obtained my certificate within few working days.

Account Department2024-03-18I recently applied for a Startup India certificate through Legal Suvidha, and I was thoroughly impressed by their professionalism. From the moment we initiated the process, we received proper guidance in every step. Saloni, one of the team member helped us very patiently and ensured a seamless procedure . Thanks to their team, that I obtained my certificate within few working days. Shaks SHAKS Shaks2024-03-18Very sharp and accurate and professional Meter & Cents

Shaks SHAKS Shaks2024-03-18Very sharp and accurate and professional Meter & Cents Harry's s2024-03-12Great service, Their Team is really hard working and amazing experience with legal suvidha now i am going to continue for all the work regarding my private limited company.

Harry's s2024-03-12Great service, Their Team is really hard working and amazing experience with legal suvidha now i am going to continue for all the work regarding my private limited company. Raghu G2024-03-06Good communication and got things quickly

Raghu G2024-03-06Good communication and got things quickly

Redefining the experience of legal services.

Now all Professional Services in a Single Click !

- Registration/Incorporation for all companies

- Income Tax Filings

- GST Registration & Filing

- Company Annual Filings

- Trademark Registration

- Licensing

Launching Soon!

Stay Updated with Latest News!

Explore more of our blogs to have better clarity and understanding

of the latest corporate & business updates.

Logo Registration

Logo Registration: Protecting Your Visual Identity Introduction In today’s competitive business world, your logo is more than just a symbol—it's...

Brand Registration in India: Securing Your Business Identity

Brand Registration in India: Securing Your Business Identity In today’s competitive market, protecting your brand identity is crucial for long-term...

IP India Public Search

IP India Public Search: What You Need to Know Introduction IP India Public Search is a vital tool provided by...

Simple Guide On Trademark Filing Process

Understanding the Trademark Filing Process Protecting your brand is important for keeping its value and ensuring it stands out in...

Registered Trademark Search: Protecting Your Brand

Registered Trademark Search: Protecting Your Brand Introduction In today’s competitive market, your brand is more than just a name or...

Trademark Search in Delhi: A Comprehensive Guide

Conducting a Trademark Search in Delhi: A Simple Guide Introduction Before registering a trademark, it's important to ensure that your...

Frequently Asked Question

Here are some answers to potential questions that may arise as you start your business.

Register your business, obtain necessary licenses, and fulfill tax obligations.

Consider factors like ownership, liability, and tax implications to choose from options like sole proprietorship, partnership, or company registration.

Choose a unique business name, obtain required IDs like Director Identification Number (DIN), and file incorporation documents with the Registrar of Companies (ROC).

Obtain GST registration, trade licenses, and any industry-specific permits required to operate legally.

Maintain accurate financial records, file tax returns on time, and adhere to the tax laws applicable to your business.

Yes, startups in India can benefit from various government schemes offering tax exemptions, funding support, and incubation facilities.

Secure patents, trademarks, or copyrights to safeguard your intellectual assets from infringement or unauthorized use.

Challenges include navigating bureaucratic hurdles, complying with complex regulations, and competing in a crowded marketplace.

Looking For More Information? Contact Us